A financial advisor's role is to help clients manage their money. Financial advisors are able to help individuals plan for retirement as well as save for their children’s college tuition. They can also help with debt management and paying down outstanding balances. This way, people have less money to spend and more money to put away for retirement. An advisor in financial planning can help individuals create and manage a budget to reach specific goals.

Questionnaire for financial advisors that includes investing components

The questionnaire that a financial advisor sends to clients asks about their investment preferences and risk tolerance. These questions are meant to provide a complete picture of a client's financial situation. These questions can include questions about how long the client plans to work and what savings they have for retirement. They ask about long-term financial obligations and pensions. This investment component of a financial advisor's questionnaire can be subjective, but the questions help the financial advisor determine the appropriate asset allocation.

When recommending investment options, financial advisors must act in the best interests of their clients. They must use the questionnaire to determine what investment options will best suit a client's risks and needs. Incorrect answers can lead to portfolios that are too risky and/or too low for the investor's capabilities. This can lead to lower returns for clients who have higher risk tolerances.

Allocation of assets

A financial advisor's role is to help individuals balance their assets. This is achieved by recommending an allocation of assets that meets your risk tolerance. Investing is a risky business, and it is crucial to have a strategy for managing risk. A financial advisor will help you determine the right asset allocation, based on both your time frame and risk tolerance.

Asset allocation is not a standard practice. Advisors have their own approaches. However, there are some key concepts that are crucial to understand and apply. A client who is more cautious about taking on risk may need to have a higher percentage of stocks or bonds in their retirement portfolio.

Planning your taxes

Financial advisors can maximize tax savings by helping you invest. They can recommend investments and offer advice about insurance and investment products. Financial planning is an important part of financial advice. It can save you thousands of dollars every year. To help clients better, financial planners may also use tax planning software.

Financial advisors with experience in tax are more likely be to find ways of reducing your taxes. They will focus more on increasing your assets than decreasing them. A compensation model may be offered that encourages growth for their clients.

Communication with a financial consultant

The first step in developing a relationship with a financial advisor is communication. It is imperative that you communicate honestly and don't hold back during meetings with your advisor. Your financial advisor must know your financial goals to be able to assist you in developing strategies that meet those goals. Also, listen to the advisor as he or she explains something to you.

You can communicate with your advisor by using social media. According to a survey, over half of investors with at least $25 million in assets use Facebook to communicate directly with their financial advisor. Another 35 percent use Twitter for keeping in touch their advisor.

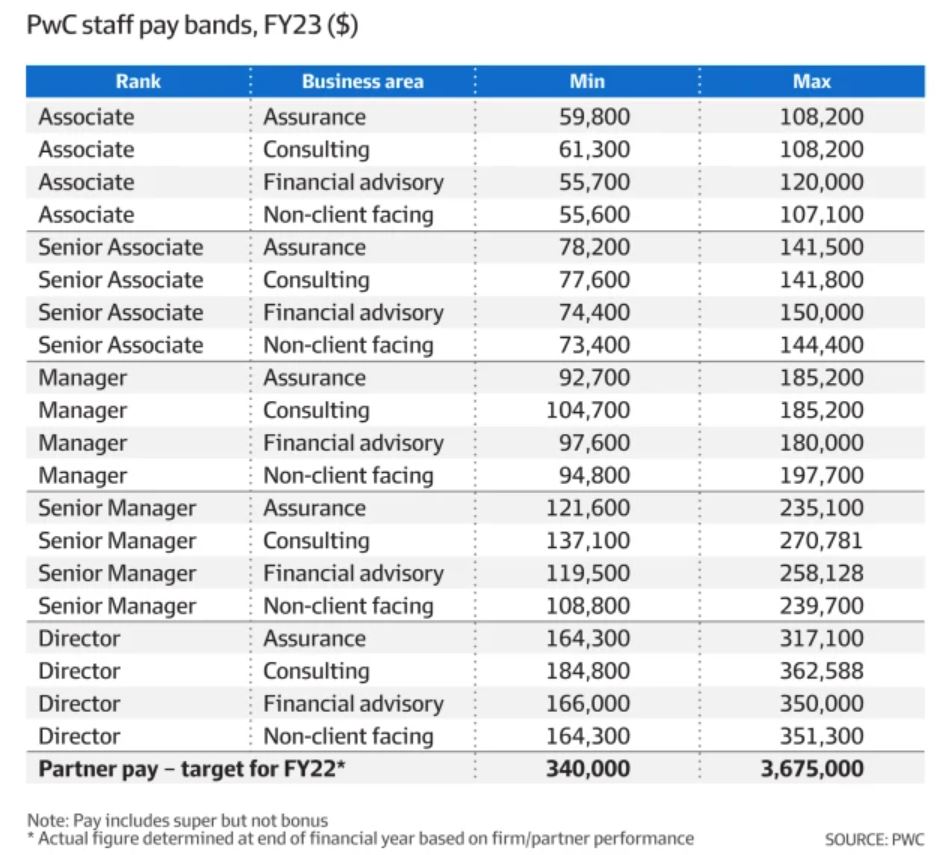

As a financial advisor, you get paid

If you decide to become a financial planner, the first thing you need to do is determine how you will be paid. You might be offered a percentage of your AUM in commissions or bonuses, or you may earn a flat fee for your services. In either case, the type of compensation will determine how much you're able to earn.

Some financial advisors make their money by selling products and commissions. Some charge an hourly service fee, while others require a monthly retainer payment for their ongoing services. You can ask your advisor any questions you may have about the preferred method.

FAQ

What qualifications does a consultant need?

You don't just need to have a MBA, you also need to demonstrate your ability as a business consultant. A minimum of two years' experience in consulting, training and/or advising a major company is necessary.

You must have worked closely with senior management teams on strategy development projects. This means you'd have to be comfortable presenting ideas to clients and getting buy-in.

You will also need to pass a professional qualification test such as the Chartered Management Institute Certified Management Consultant certification (CMC).

What can I expect from my consultant?

After you have selected your consultant, expect to hear from them within a few business days. They will often ask about your company's mission, goals and products. After that, they will send you a proposal detailing the scope of work, expected time frame, fees and deliverables.

If all goes according to plan, the two sides will sign a written deal. The terms of the contract will depend on the type of relationship between the two parties (e.g., employer-employee, employer-independent contractor).

If everything goes smoothly, the consultant can begin work immediately. S/he will have access to your internal documents and resources, and you'll have access to his/her skills and knowledge.

However, don't assume that just because someone is a consultant that s/he knows everything. It takes effort and practice to become an expert in whatever field you consult. So, don't expect your consultant to know everything about your business.

Is it possible that a consultant business can be started from home?

Absolutely! Actually, this is what many consultants already do.

Freelancers often work remotely through tools like Skype and Trello, Basecamp, Basecamp, Dropbox, and Slack. They may even create their own office space in order to take advantage of company perks.

Freelancers might prefer to work in libraries or cafés, rather than traditional offices.

Some choose to work remotely because they are surrounded by their family.

There are pros and cons to working remotely. If you love your job, working from home is definitely something worth looking at.

Which industries use consultants?

There are many different types of consultants. Some consultants are focused on a specific type of business, others may specialize in multiple areas.

While some consultants only work for private companies, others represent large corporations.

Some consultants can also help businesses all around the globe.

What does it cost to hire an expert?

Many factors go into determining how much it costs to hire a consultant. These factors include:

-

Project size

-

Time frame

-

Scope of work

-

Fees

-

Deliverables

-

Other considerations include experience level, geographic location, and so forth.

Statistics

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- My 10 years of experience and 6-step program have helped over 20 clients boost their sales by an average of 33% in 6 months. (consultingsuccess.com)

- So, if you help your clients increase their sales by 33%, then use a word like “revolution” instead of “increase.” (consultingsuccess.com)

- WHY choose me: Why your ideal client should choose you (ex: 10 years of experience and 6-week program has helped over 20 clients boost their sales by an average of 33% in 6 months). (consultingsuccess.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

External Links

How To

What does a typical day look like for a consultant?

The type of work that you are doing will affect the typical day. You'll spend your time researching new ideas and meeting clients.

Clients will often meet with you to discuss their problems. These meetings may be over the phone via email, on-line, or face-to–face.

The proposal is a document that outlines your ideas and plans to clients. You will need to discuss these proposals with a mentor or colleague before you present them to clients.

After all the preparation, you'll need to start creating content. Writing articles, designing websites, editing photos or conducting interviews are just some of the options.

It depends on the project's scope, you might need to do some research to collect relevant statistics. For example, you may need to find out how many customers you have and whether they are buying more than one product or service.

Once you have all the information needed, it is time for clients to see your findings. You can either present your findings in writing or orally.

You must also follow up with clients following the initial consultation. For example, you could call your clients periodically to check how things are going. Or send them emails asking them to confirm they have received the proposal.

This is a long process that can take some time. However, it is crucial to stay focused and to maintain good relationships.