There are many factors to consider when choosing an investment advisor. You will learn about fiduciary responsibility, conflicts, hourly rates, retainer fees, and Fiduciary liability. This is why it is important to choose an investment adviser who adheres to these regulations. Register your advisor with the Securities and Exchange Commission, or the state securities agency.

Fiduciary responsibility

A fiduciary duty requires investment advisors to act in the client's best interests and disclose material facts to avoid conflicts of interest. Financial liability and civil liability can be triggered by a breach of fiduciary duties. Excessive trading, improper margin trading and false representations regarding securities are all examples of violations of fiduciary obligation.

Fiduciary duty is the requirement that investment advisors act in the best interests of the client, keeping the client's interests at heart. This means they have to make sure that the advice they offer is in line with the client’s goals. To do this, advisors need to have enough information about the customer's finances. Fiduciaries typically decide what is in the client’s best interest and then discuss it.

Conflicts between interests

Investment advisors must disclose potential conflicts to clients. This disclosure must include information about the nature, management, and mitigation of conflict. It must also be disclosed at the time the adviser makes a recommendation to the investor for continuing holding an investment. The specific circumstances of the relationship between an adviser and a client will determine whether or not there is a conflict of interests.

Conflict of interest refers to a situation in which the financial interests of both the client and the investment advisor are not aligned. For example, an investment professional may have a financial incentive to sell a certain security. The advisor is paid a commission by the broker who introduced the investor to this security. Advisors will be more inclined to find the best investments, as they will receive the highest commissions.

Hourly rates

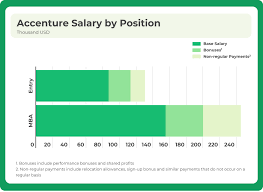

Investment advisors can charge hourly, flat, or other fees depending on how much time they are spending with their clients. These fees are usually disclosed up front. Before paying, clients should request to see the invoice. Hourly rates are also affected by experience and specialty. Experienced advisors will charge more than less-experienced advisors.

The hourly fee structure is popular among firms offering investment advice. When the service is one-time, the hourly fee is affordable. For ongoing management, you may prefer a flat rate, or a percentage, however.

Retainer charges

Although commission-based advisors are attractive for their low cost, they may not be the right choice for every client. Such advisors are salespeople and earn commissions based on sales of their clients' financial products. These products might include mutual funds and stocks as well as insurance. Retainer-based advisors, on the other hand, do not charge commissions and are more transparent.

Retainer-based planning prevents conflicts of interest. The advisor gets paid 1% to 2% of the portfolio's total value. The advisor would make $5,000 to $10,000 per annum if the client had a $500,000 portfolio. This type of arrangement can be costly and may create conflict of interests. Additional income can be earned by retainer-based advisors from the implementation or modification of client's investments plans.

Choosing an investment advisor

The best financial decision you will make is choosing an investment advisor. It is crucial to find an investment advisor that is registered and accredited. Has a proven track record and offers advice. It is also important to choose a professional that is a member of Canada's Investment Industry Regulatory Organization (IIROC), which oversees compliance and regulates all investment dealers in Canada.

There are many different types. Your specific goals will determine which advisor is best for you. Although past successes do not guarantee future results, having a strong relationship can build trust and open communication with an advisor. You want someone who is open to communicating with clients and who focuses on long-term goals, rather than making decisions based on emotions.

FAQ

How do I attract clients to my consultancy business

Finding a passion area is the first step. It could be anything from social media to public relations, but there must be something you feel strongly about. You may need to start small and find a niche market like web design. Once you find the right niche, it is important to know what makes it tick. What problems can it solve? Why should people use it? What can you do to support them?

You could also approach businesses directly. Perhaps they are looking for someone who can help them understand SEO and content creation or just need advice on social media strategy.

If all else fails, why not offer your services at free events like networking evenings and conferences? It's a great way to get in touch with potential customers, without spending too much on advertising.

How long does it usually take to become an expert consultant?

The length of time required varies depending on your background and industry. Most people start out with a few months before they find work.

Some consultants work for years to perfect their skills, before being hired.

What are the types of contracts available to consultants?

Standard employment agreements are signed by most consultants when they are hired. These agreements detail the length of the consultant's contract with the client, the amount he/she is paid, and other important details.

Contracts can also indicate the areas of expertise that the consultant will concentrate on and the compensation they will receive. For example, the agreement may say that the consultant will provide training sessions, workshops, webinars, seminars, etc.

Other times, the consultant simply agrees to complete specific tasks within a specified timeframe.

In addition to standard employment agreements, many consultants also sign independent contractor agreements. These agreements allow the consultant to work independently but still receive payment for his/her efforts.

What qualifications do you need to become a consultant in order to get your degree?

Learning a lot about a subject and then applying it to your life is the best way to be an expert.

Learn how to be a great consultant by studying now!

A degree without relevant experience may make it difficult for you to be hired. If you can show that your education is comparable to the job applicants, you may still be eligible for employment.

Employers are always looking for people with real-world knowledge.

How did modern consulting come to be?

The first consultants were accountants who helped companies manage their finances. They were able to manage financial information and became "accounting experts". However, this role soon expanded into other areas, such as human resources management.

The French word for "to advice" was the inspiration behind the term "consultant." This was used by businessmen as a way to describe someone who could provide guidance on running an organization. Today, business owners still use the term consultant to refer to any type of professional advisor.

Statistics

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- WHY choose me: Why your ideal client should choose you (ex: 10 years of experience and 6-week program has helped over 20 clients boost their sales by an average of 33% in 6 months). (consultingsuccess.com)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

External Links

How To

How to find the best consultant

First, ask yourself what kind of consultant you are looking for. Before you start looking for someone to work with, it's important that you know your expectations. Make a list of everything you think you might need from a consultant. This list could include technical expertise, project management skills, communication skills and availability. After you have listed your requirements, it might be a good idea to ask colleagues and friends for their recommendations. Ask them what their experience with consultants was like and how they compare to yours. You can also do some online research if you don't know of any. Many websites allow people to post reviews about their work experience, including Angie's List and Indeed. Look at the ratings and comments left by others and use this data as a starting point for finding potential candidates. Finally, once you've got a shortlist of potential candidates, make sure to contact them directly and arrange an interview. During the interview, you should talk through your requirements and ask them to explain how they can help you achieve those goals. It doesn’t matter if the person was recommended to you; it matters that they understand your business goals, and can show you how they can help.